How To Set Up Equity Accounts In Quickbooks

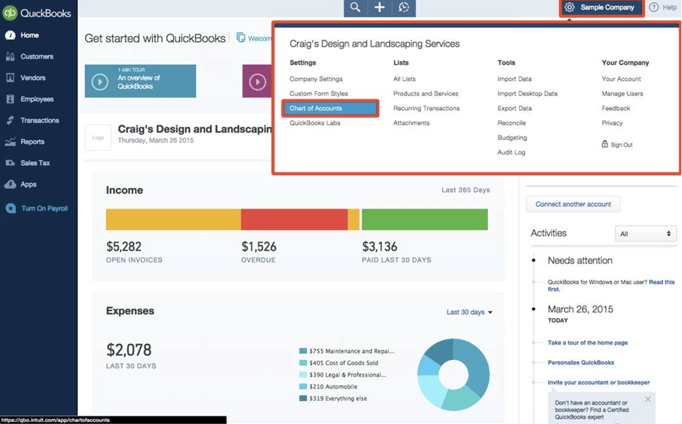

At present is a expert time to clean up and optimize your QuickBooks accounting organisation... and the best place to start is the chart of accounts in your business's full general ledger. A chart of accounts acts like a table of contents for an accounting organization, listing all of the business's accounts and their code numbers. The chart of accounts is made up of five basic categories: nugget, liability, equity, acquirement and expense accounts. When creating financial statements, it'southward critical that accounts are matched to the proper financial report. If a business does not ready and use its ledger accounts correctly, its financial statements will exist out of whack! We'll explain some of the dire consequences of an improperly maintained chart of accounts, but first, let's review what makes upward a nautical chart of accounts. Revenue and expense accounts are used to create your income statement; asset, liability and equity accounts are used to generate your balance sheet. Accountants typically blueprint a nautical chart of accounts according to generally accepted accounting principles (GAAP), then add sub class accounts based on the business's industry and construction. Asset Accounts Asset accounts record what a concern owns. The two types of nugget accounts are: electric current assets and fixed assets. Current assets – The avails endemic by the business organization that can be converted to cash within ane year. These accounts include bank checking and savings accounts, accounts receivables and inventory. Fixed assets – The assets the company bought to help run the business which will not be resold. These accounts include buildings, equipment, computers, office furniture and vehicles. When these types of avails are purchased, they are recorded as fixed assets instead of an expense. As fixed avails, the purchase cost can exist expensed gradually through depreciation of the asset during its useful life. Liability Accounts Liability accounts record what a business owes. At that place are two types of liability accounts: current liabilities and long-term liabilities. Current liabilities – The liabilities that must be paid within one year. These include accounts payable to vendors and the government for payroll and sales taxes, and brusque-term loans such as credit cards. Long term liabilities – The liabilities that can be paid over a longer period of time than i year. These include long term banking company loans, majuscule leases and mortgages. Equity Accounts Equity is divers equally the net worth of a business, calculated by showing assets minus liabilities. The equity accounts listed in a business'south chart of accounts depend on how the business concern's legal structure. Sole proprietorship - When there'due south just 1 possessor in a business, the disinterestedness accounts are owner's upper-case letter, owners draw and retained earnings. Note: for both the sole proprietorship and partnership types of businesses, the possessor is not considered an employee and does non earn wages from the business organization. Corporation – A corporation is a legal entity owned by shareholders. The disinterestedness accounts in the chart of accounts for a corporation are called: capital letter stock, shareholder distribution and retained earnings. A sub business relationship is prepare for each shareholder. Limited Liability Company (LLC) – This business structure combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. The equity accounts for an LLC depend on the number of members in the business. Nonprofit - A non-profit business is a taxation-exempt organization formed for religious or charitable purposes. The disinterestedness accounts for a nonprofit are chosen restricted net assets and unrestricted cyberspace assets. Acquirement Accounts Revenue accounts are the income a business receives from the auction of its products or services. Acquirement account names include sales acquirement, income for services, professional person fees and commissions. Expense Accounts Expense accounts represent the costs associated with doing business. The ii categories of expense accounts are directly expenses and indirect expenses. Common Chart of Account Bug The chart of accounts in QuickBooks is designed to be easy to utilize for concern owners who don't have an accounting background. However, that ease of admission can likewise wreak havoc on the chart of accounts of a growing concern. You should exist aware of how features of QuickBooks can influence your business concern's chart of accounts. What happens when a business needs to record a transaction in QuickBooks, but tin can't find a matching account name in the chart of accounts? QuickBooks allows you lot to make up a new account name which y'all think better fits the transaction description. Unfortunately, this practice tends to screw out of control. While onboarding new clients, we've found businesses with more than 300 items in their chart of accounts. A large number of items is hard to manage. An affluence of accounts can lead to items being placed in the wrong business relationship categories and, every bit a outcome, inaccurate financial statements. If the chart of accounts doesn't supply revenue and expense account totals, it is difficult to job cost. QuickBooks must be modified to obtain those accounts' balance totals on the chart of accounts. For task costing, a best practice is to separate expense accounts, non alphabetically, merely in direct expenses and indirect expenses categories. With that method, straight expenses associated with a job tin can be more than readily identified and allocated against a specific job. Chart of Accounts Best Practices Remember the proverb "less is all-time," when it comes to your nautical chart of accounts. Hither are some of the best practices to follow to improve and maintain your chart of accounts. Reduce the size: Review your accounts to identify those with small-scale amounts relative to the size of your business. Unless the account is necessary for managerial reporting, delete the business relationship and curlicue it into a larger account. By periodically paring down accounts, you lot will proceed the chart of accounts at a more than manageable level. Keep it consequent: Create a nautical chart of accounts that can work for your business organization as it grows, and be sure to keep that chart intact. By keeping the chart consistent, you will be able to compare the results in each account from month to month and year to year. When yous gradually expand the number of accounts over fourth dimension, you will find it difficult to calculate comparable numbers for more than the by year. Lock down users: Use the lock-down feature in QuickBooks to limit subsidiaries and non-authorized employees from changing the standard chart of accounts. When a concern has alternate versions of the nautical chart of accounts, you will have a hard time consolidating the financial results of the concern. The Importance of the Chart of Accounts When designing or altering a nautical chart of accounts, you must keep in mind that each account is associated with a fiscal statement: the residual sail, the income statement or disinterestedness statement. Remember that the three financial components are all interrelated. You cannot have an account item on the balance canvas without having a related account on the income statement and vice versa. By following this accounting standard, you will have a chart of accounts that accurately reflects your business'south ability to make a profit, generate income and create equity.

Partnership - A business partnership is established with more than one possessor. The equity accounts in the chart of accounts are chosen partner'southward upper-case letter, partner's draw and retained earnings. Carve up accounts are set upward for each partner nether partner's capital and partner's describe.

such as hire, payroll and part supplies expenses.

Source: https://www.growthforce.com/blog/3-ways-to-optimize-your-quickbooks-chart-of-accounts

0 Response to "How To Set Up Equity Accounts In Quickbooks"

Post a Comment